53

The US remains the largest market for diamonds in

the world. Total US retail sales of diamond jewellery

reached pre-2009 downturn levels in 2013 while

polished diamond content in jewellery increased by

20 per cent from 2008. Overall, the US accounted

for approximately 40 per cent of global polished

diamond consumption by value in 2013.

The US consumer market is made up of women’s

jewellery, men’s jewellery and jewellery for adolescent

girls, called ‘teens’ jewellery’. Of those three segments,

women’s jewellery represents by far the largest portion

of total diamond jewellery sales, with well over 90

per cent of sales value.

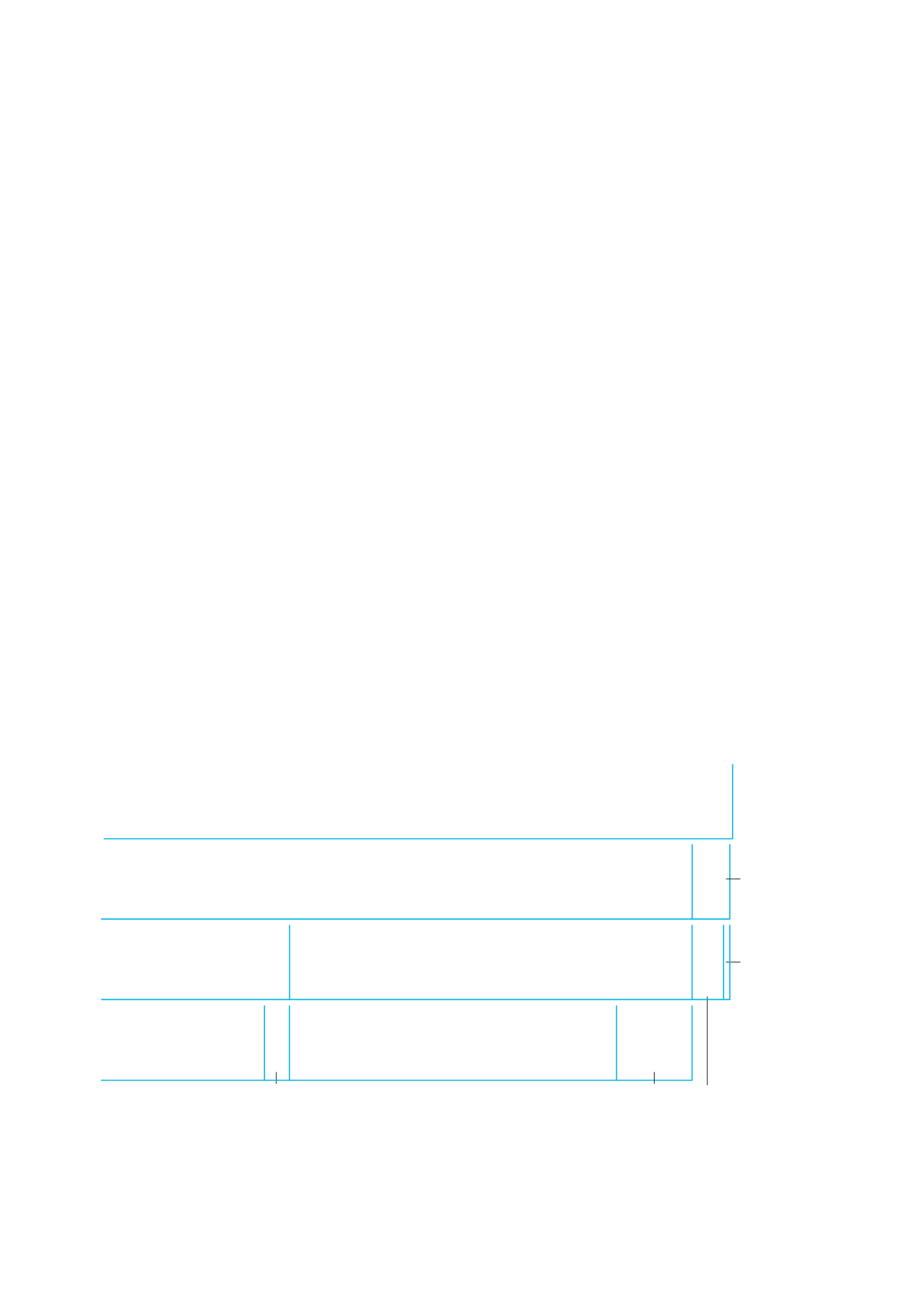

Traditionally, two major segments of diamond

jewellery have been analysed in the US women’s

category: bridal jewellery (including diamond

engagement rings (DER) and diamond wedding

bands (DWB)) and non-bridal jewellery (which can

be further subdivided into married women’s diamond

jewellery (MWDJ) and single women’s diamond

jewellery (SWDJ)) – see Fig. 32.

Non-bridal diamond jewellery is the largest segment

by value in the US. In 2013, it accounted for over

four in five pieces and about two-thirds of sales value

of women’s DJ. However, compared with the pre-

recession state of the US market, this segment has

lost share both in volume and in value to the bridal

segment (see Fig. 33).

This shift has been driven by two changes. Firstly, the

number of DER pieces sold has increased and the

average price per DER piece has grown even more

rapidly than unit sales. The average DER price is

more than three times higher than the average price

for other women’s jewellery. As a result, in 2013 DER

accounted for a little over one in 10 pieces sold, but

represented close to 28 per cent of retail market value

of women’s DJ.

Secondly, within the non-bridal segment, the two

sub-sets – MWDJ and SWDJ – have behaved quite

differently since the economic downturn. Over this

period, the share of MWDJ has declined in volume

of pieces, while its share of value has gone up slightly.

At the same time, the SWDJ segment has retained its

share of volume, but its share of value has declined.

Note: Area of rectangles reflects approximate proportion of total market by value

F I G . 3 2 :

D I AMOND JEWELLERY ( DJ ) MA I N CONSUMER SEGMENTS I N THE

UN I TED STATES ( 20 1 3 )

Source: De Beers

Men’s &

Teens’ DJ

6

Total DJ demand

100

MWDJ

52

SWDJ

12

Bridal DJ

30

Non-Bridal DJ

64

Men’s DJ

5

Women’s DJ (WDJ)

94

DER

26

DWB

4

Teens’ DJ

1

Per cent of DJ value

THE UNITED STATES

OPPORTUNITIES EMERGING DESPITE CHALLENGING

ECONOMIC CONDITIONS