54

These trends reflect, in part, the impact of the

economic downturn experienced by married and

single women in the US:

Married women in households most affected by

economic pressures exited the category while

those who acquired received more expensive

pieces on average.

Single women continued to acquire pieces but at

lower prices on average.

FINE JEWELLERY IS FACING STRONG COMPETITION FROM

OTHER CATEGORIES

It is clear that, as the US economy recovers from the

financial crisis, the new consumer landscape holds

both challenges and promise for diamond jewellery.

First of all, fine jewellery is facing strong competition

from other luxury and experiential categories. In

2013, fine jewellery was not among the top five on the

list of gifts that US women would most like to receive,

ranking behind holidays (foreign and domestic),

electronics, home furnishings and spa days. Among

young people (aged 18-34), the desirability of fine

jewellery ranked below branded luxury products such

as designer handbags and clothing. However, diamonds

were still the most popular choice for fine jewellery for

all age segments; in fact, diamonds were almost three

times more popular than any other type of jewellery.

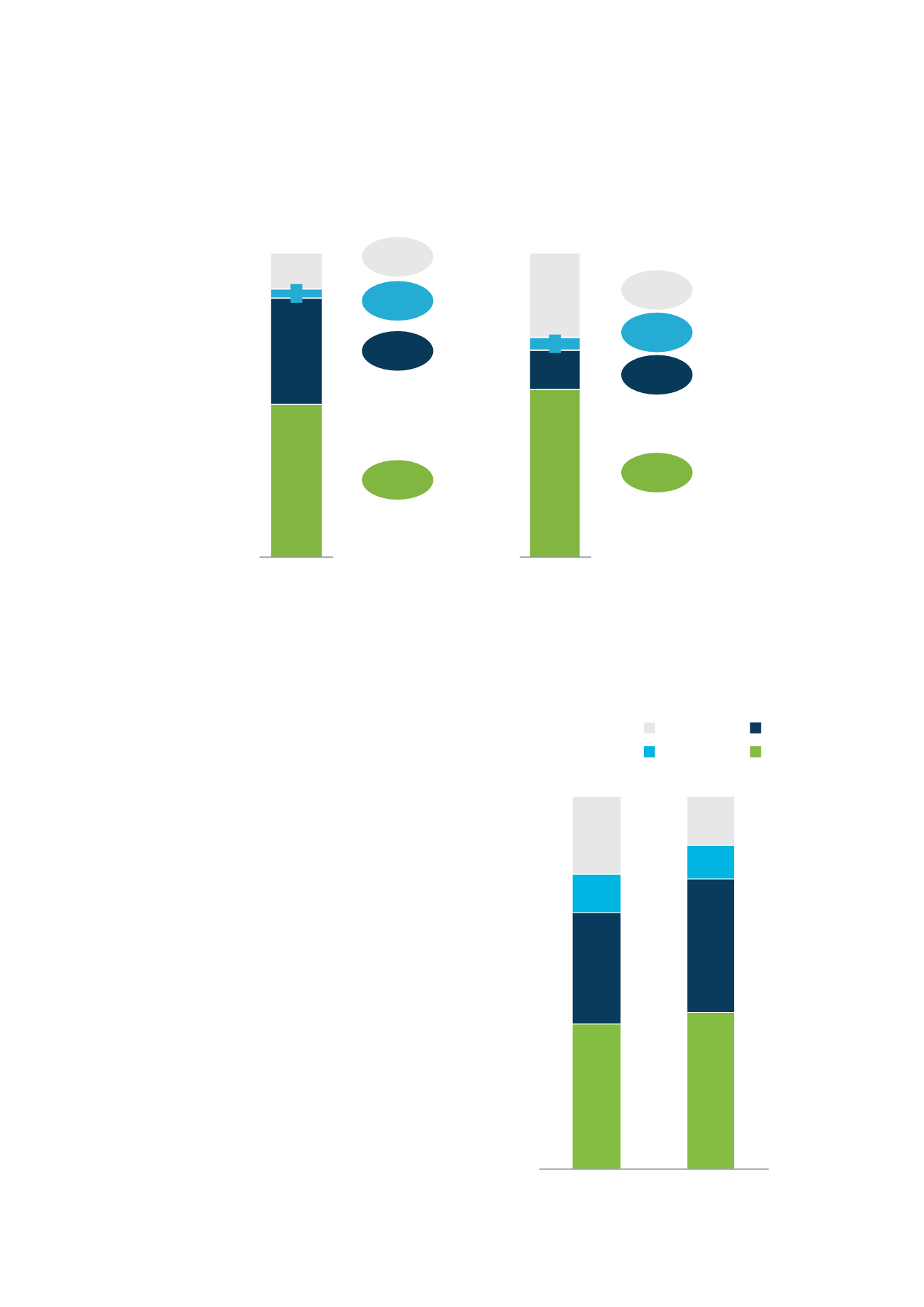

F I G . 3 3 :

BREAKDOWN OF WOMEN ' S D I AMOND JEWELLERY SHARE BY

SEGMENT I N THE UN I TED STATES

Source: De Beers

50

35

12

Married

Women

(MWDJ)

Single

Women

(SWDJ)

DWB

i

DER

Pieces

3

+6.2

-0.6

-0.3

55

13

28

Value

4

+8.1

-0.6

-8.8

US$3,700

US$600

US$1,400

SHARE CHANGES VS 2007

Percentage points

SHARE CHANGES VS 2007

Percentage points

AVERAGE PRICE

Paid in 2013

-5.3

+1.4

US$2,300

i

In 2013, diamond wedding band (DWB) defined as ring with a setting of diamonds in a single row, all about the same size

Per cent (by pieces and value)

BRIDAL

NON-BRIDAL

FIG. 34:

SHARE OF ADVERTISING VOICE IN THE

UNITED STATES

Source: Mindshare

2013

100

42

36

9

13

2007

100

39

30

10

21

Time pieces

Jewellery

Fashion

Electronics

Per cent