55

Part of the explanation for this relative weakness

of fine jewellery in consumers’ preference may

be that other luxury and discretionary categories

have continued to compete far more strongly for

consumers’ attention. Share of advertising voice

for fine jewellery within the US luxury segment has

declined over the last seven years (from 21 per cent

in 2007 to 13 per cent in 2013 – see Fig. 34)

35

.

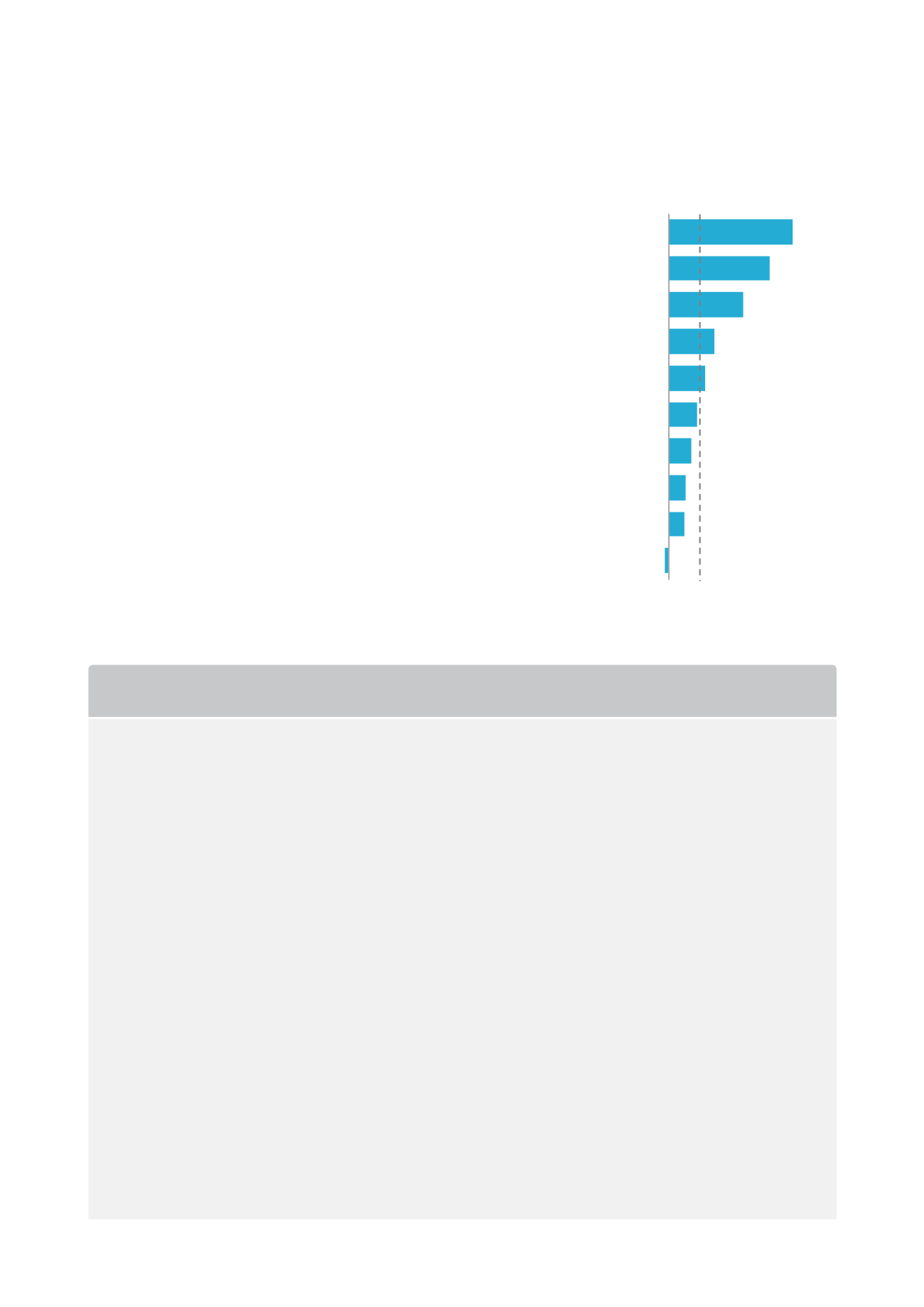

Overall, the fine jewellery category has been growing

at a slower rate than other discretionary and luxury

goods for some time (see Fig. 35). Luxury jewellery

sales grew at a compound annual growth rate of just

below two per cent between 2004 and 2013, well

behind luxury electronic gadgets (14 per cent), fine

wines (11 per cent) and premium beauty/personal

care (eight per cent)

36

.

In addition, a growing number of Americans facing

financial strain in the aftermath of the financial crisis

have resorted to recycling jewellery. The experience

customers sometimes encountered when trying to

sell back their jewellery pieces, especially to non-

specialised businesses, could also have played a role

in impacting upon the product’s relative desirability

(see the ‘Trends to Watch’ box).

FIG. 35:

GROWTH OF LUXURY CATEGORIES IN THE

UNITED STATES

Source: Euromonitor

TOTAL LUXURY MARKET =

3.6

CAGR,

2004-2013

Design apparel

Luxury writing instruments

and stationery

(0.5)

1.8

Luxury jewellery

1.9

Luxury time pieces

2.5

Luxury tobacco

Luxury travel goods

3.1

4.1

Luxury accessories

5.1

Super premium beauty and

personal care

8.3

Fine wines, champagne, spirits

11.2

13.7

Luxury electronic gadgets

Per cent

DIAMOND JEWELLERY RECYCLING

Trading of previously owned diamonds (sellback, trade-up) is a normal part of the lifecycle of

jewellery and forms a growing segment of the diamond jewellery industry. However, this activity

has attracted greater attention in the diamond industry in recent years, as its scale was boosted

not only by the global economic downturn but also by the accompanying appreciation of gold

prices during that period. In many cases, consumers wanted to sell back their gold jewellery,

and diamonds were simply a by-product; on other occasions, the diamond was the main item

being sold back.

Due to the lack of a reliable buy-back offer from traditional retailers, US consumers have

increasingly turned to pawnbrokers and to high-visibility, non-specialised new entrants to sell

back their diamond jewellery. Consumers who have sold diamond jewellery through these

channels have often left dissatisfied, especially due to a perceived lack of transparency and

objectivity in the pricing of their jewellery. Consumers who trade up their diamond jewellery

through specialised channels are generally less dissatisfied with their experience.

The recycling trend could undermine trust in the diamond industry and consumers’ belief in

the diamond dream. The industry will need to continue to work towards offering consumers

expert advice and clear choices when it comes to recycling of diamond jewellery.

TRENDS TO WATCH