60

CHINA

A STORY OF GROWTH AND EVEN GREATER

GROWTH POTENTIAL

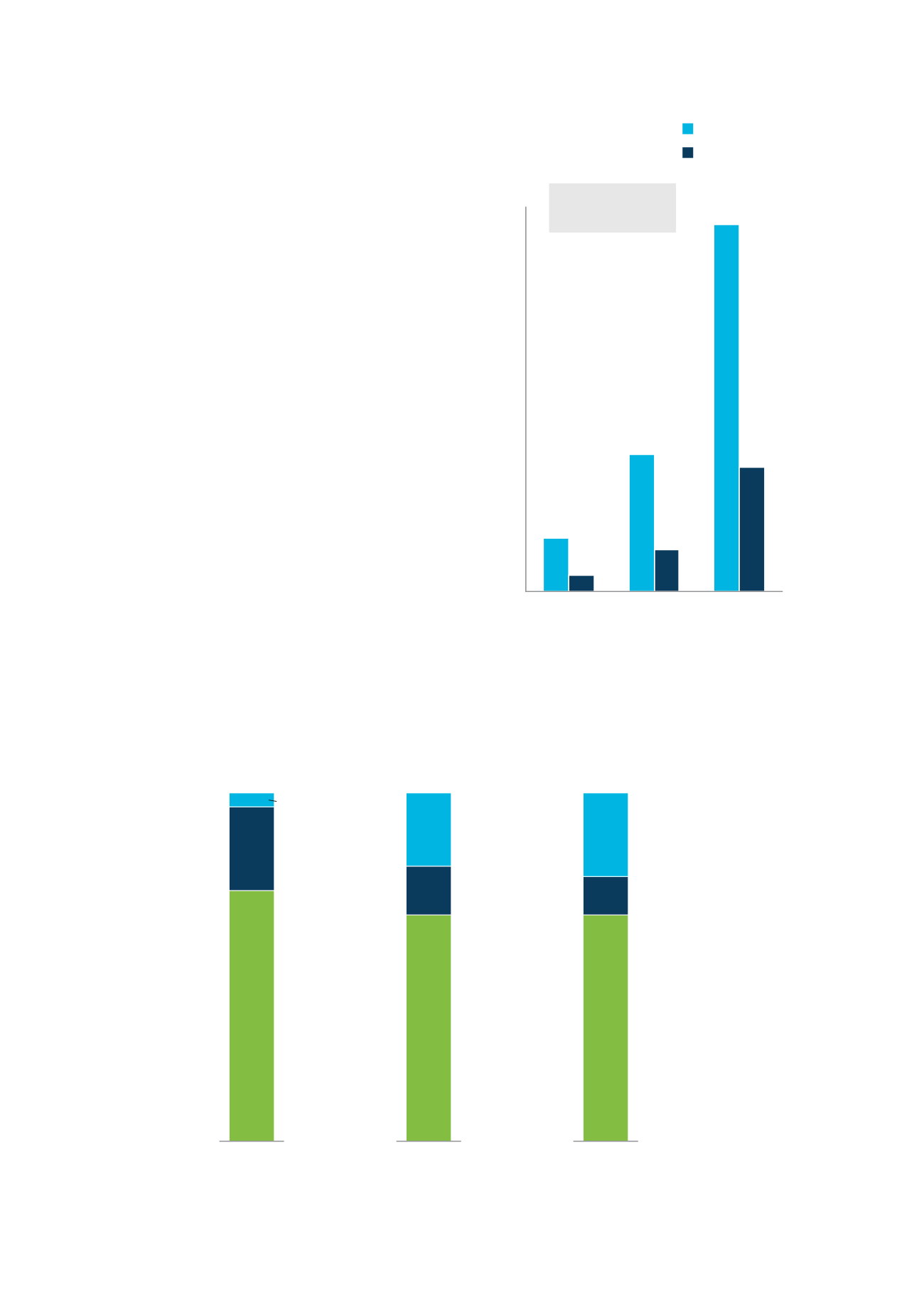

Sales of diamond jewellery to Chinese consumers

were the fastest growing in the world over the last

decade, with a compound annual growth rate of 21

per cent from 2003 to 2013 (see Fig. 40). As a result,

the share of polished diamonds sold in jewellery to

Chinese consumers grew from barely three per cent

in 2003 to just over 13 per cent of global demand in

2013. Including Hong Kong and Macau, the share

of this region’s consumers in the global demand

of polished diamonds in jewellery was almost

16 per cent in 2013 in USD.

This vertiginous growth in demand for diamond

jewellery has been driven by growing numbers of

consumers able to buy into the category, and by

the increase in the average price and the sizes of

diamonds they can afford to buy. Average prices

paid jumped by 32 per cent in real terms between

2003 and 2013, to over RMB 8,000 (US$1,300)

(see Fig. 41). Average carats per piece over the

same period rose from 0.18 to 0.25.

Source: De Beers

Per cent (by acquirers, pieces and value)

F I G . 4 1 :

20 1 3 CH I NESE D I AMOND JEWELLERY BY SEGMENT

AVERAGE PRICE PAID IN 2013

72

24

4

Bridal

Consumers

Single women

Married women

65

14

21

Pieces

Note: The 2013 FX assumed is US$1 = RMB 6.1905. All prices rounded

65

11

24

Value

RMB 10,300(US$1,700)

RMB 7,000(US$1,100)

RMB 9,000(US$1,500)

FIG. 40:

DIAMOND SALES TO CHINESE CONSUMERS

Source: De Beers

USD million (nominal)

10,000

8,000

6,000

4,000

2,000

0

2013

2007

2003

Polished diamond value

Diamond jewellery value

2003 –2013 CAGR

Diamond jewellery: 21%

Polished value: 23%