61

THERE IS STRONG POTENTIAL FOR FURTHER GROWTH

Fine jewellery is the object or experience most desired

by urban women in China. Asked to select from a

list of competitive items or experiences they most

coveted, almost half (48 per cent) of Chinese women

selected fine jewellery, a much higher percentage

than the next most desirable gift item – designer

handbags, chosen by just under a third of Chinese

women. Among types of jewellery, diamond jewellery

was by far the most popular choice, with about two-

thirds of female consumers selecting it as their first

or second preference (see Fig. 42).

Even so, China remains underpenetrated: while

diamond jewellery ownership has risen to 20 per cent

in the top urban cities surveyed (up from just 10 per

cent in 2003), it is still far below the US ownership

rate of approximately 70 per cent.

The consumer base is likely to continue to widen as

the portion of the Chinese population able to buy into

the category expands further. McKinsey & Company

predicts that, by 2020, ‘mainstream’ consumers –

relatively well-to-do households with annual disposable

income of between US$16,000 and US$34,000 – will

make up 51 per cent of urban households (from

six per cent in 2010), and affluent households with

annual incomes of more than US$34,000 will make up

six per cent (from two per cent in 2010 – see Fig. 43)

39

.

In addition, consumers who have already bought

diamond jewellery are expected to find additional

occasions to buy diamonds.

The number of wealthy individuals has also grown

strongly in China. In its 2013 Wealth Report, Credit

Suisse estimates the number of Chinese millionaires

(ie individuals with assets above US$1 million) to be

1.1 million in 2013, up 90,000 in one year alone

40

.

According to global consultancy Capgemini, China

has the fourth-largest number of high net-worth

individuals (HNWI, those with investable assets

of over US$1 million), reaching 643,000 in 2012,

up just under 16 per cent on 2011

41

. A 2014 study

by consultancy WealthInsight shows that together,

Beijing (sixth in the list of the top 10 cities with most

millionaires) and Shanghai (ninth on the list) have

more USD millionaires (excluding the value of their

primary residences) than London

42

.

This potential for growth is recognised by the big

Chinese jewellery chains. Their store network

expansion has continued apace over the past three

years, leading to an estimated total of, approximately,

15,500 stores offering diamond jewellery in 2013 – 29

per cent more than in 2010. Chow Tai Fook, a leading

specialised jewellery chain, has disclosed its aims to

open a net of 200 jewellery points of sale each year

in the medium to long term (see Fig. 44)

43

. This is a

further indication of local retailers’ confidence in the

prospects for diamond jewellery in China.

FIG. 42:

CHINESE WOMEN'S DESIRE FOR DIAMONDS

AND COMPETING ITEMS

Source: De Beers

A genuine

luxury

watch

25

27

A holiday

abroad

31

30

A genuine

designer

handbag

31

31

A desktop

PC, laptop,

netbook,

tablet PC

36

17

A piece

of fine

jewellery

48

48

DIAMOND

Self purchase

Gift

ALL OTHER

Per cent selected as first choice, 2012

-4

20

27

1

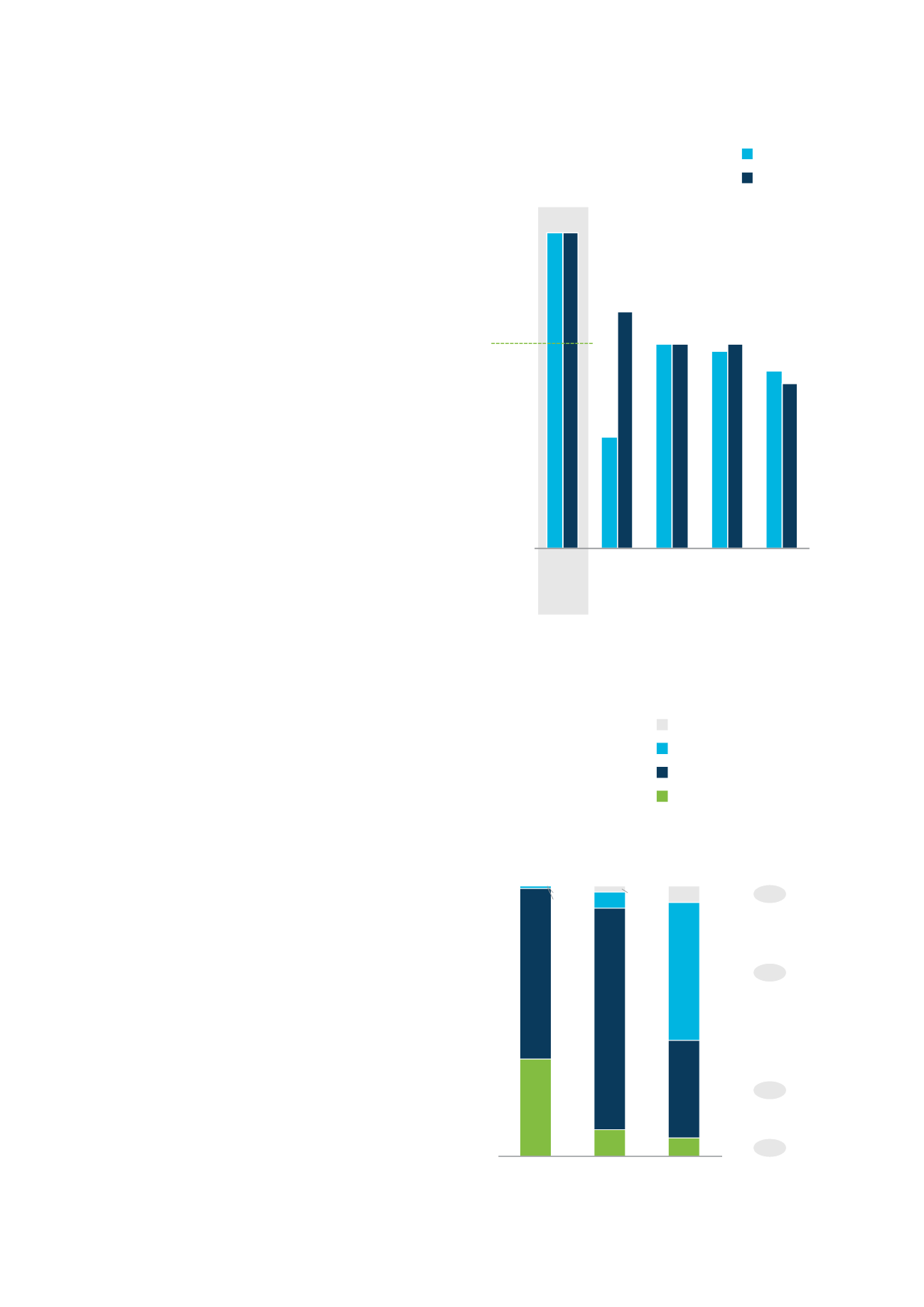

FIG. 43:

SHARE OF URBAN HOUSEHOLDS BY

ANNUAL HOUSEHOLD INCOME

i

Source: De Beers

7

36

51

6

2020

100

2010

2

100

10

6

2000

100

82

1

0

63

36

Poor (<US$6,000)

Mainstream (US$16,000–34,000)

Value (US$6,000–15,999)

Affluent (>US$34,000)

Projected CAGR

2000–2020

Per cent

i

In real 2010 dollars; in 2010, US$1 = RMB 6.73

Per cent