67

ESCALATING COST AND COMPLEXITY

Finding, developing and mining kimberlite pipes

in some of the world’s most inhospitable places

are astonishing feats of engineering and human

ingenuity. They each require enormous investments

in exploration, project development, infrastructure,

mine equipment and also human capital – training

miners to mine in a safe and sustainable way.

The cost and capital intensity of diamond mining

projects are rising, for three main reasons. Firstly,

global demand for capital goods has driven price

increases in equipment. At the same time, operating

costs in some of the major mining geographies

have increased significantly over the last few years.

In Botswana, for example, the cost of electricity

increased 11 per cent per year between 2002 and

2012

46

and labour costs increased 14 per cent per

year

47

. In Russia, the price of electricity increased

12 per cent per year over the same period

48

and

labour costs 19 per cent

49

, while in South Africa

power prices have risen by an average of 14 per

cent over the same period

50

(see Fig. 48).

Secondly, diamond miners are developing deeper

and more remote parts of existing deposits, such

as the Jwaneng Cut 8 project or the Venetia

Underground mine.

Finally, new projects are further away, in more hostile

natural environments that include the Arctic. Such

operations are inherently more complex to run and

involve greater infrastructure investments.

Miners go to extraordinary lengths to bring diamonds

to market. This has always been the case and supply

will continue to increase as demand grows. However,

this cannot happen without substantial effort and

investment. The cost and complexity of mining

diamonds will continue to increase, and diamonds will

remain one of the most coveted of earth’s products.

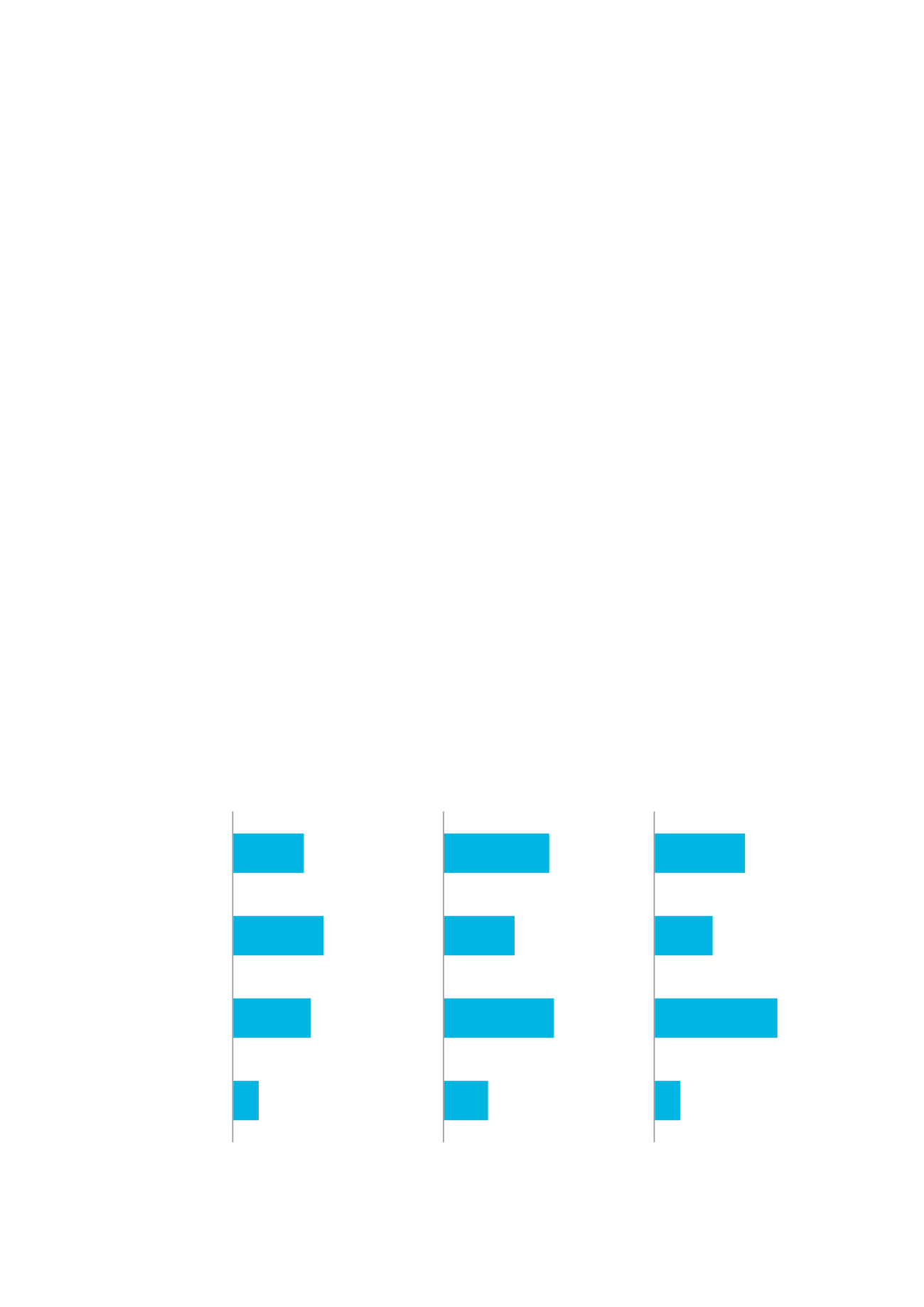

F I G . 48 :

COSTS I NCREASES ACROSS THE MOST COMMON OPEX I NPUT

FACTORS

Canada

4

Russia

12

South Africa

14

Botswana

11

ELECTRICITY

DIESEL

17

7

11

16

i

9

4

19

14

ii

LABOUR

Source: South Africa: Eskom, SAPIA, South Africa Department of Mineral Reserves; Botswana: Ministry of Minerals, Energy and Water Resources,

Botswana department of statistics, press searches; Russia: Russian Statistics

i

From 2006 to 2012

ii

From 2002 to 2011

CAGR 2002-2012 in local currencies (nominal), per cent