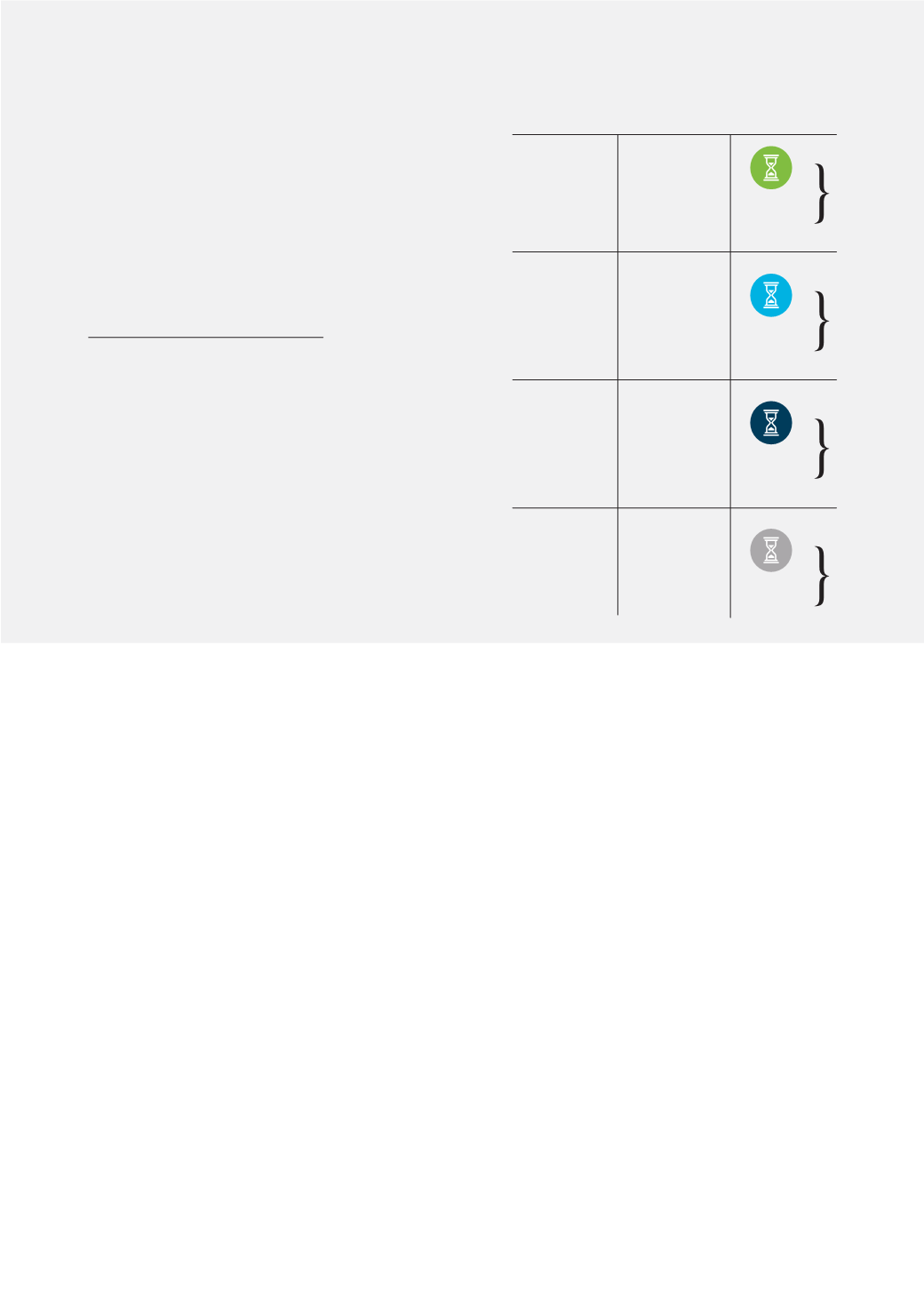

68

FROM

D I SCOVERY

TO START OF

PRODUCT I ON

Time lapse to

development has

increased for

diamond mines.

Mir

Aikhal

Udachny

Orapa

International

Jwaneng

Jubilee

Argyle

Catoca

Ekati

Zarnitsa

Komsomolskya

Nyurba

Diavik

Arkhangelskaya

Victor

Snap Lake

Grib

Karpinskogo-1

Botuobinskaya

Gahcho Kué

Renard

M I NE

4 years

1 year

16 years

4 years

2 years

10 years

10 years

6 years

29 years

17 years

45 years

26 years

5 years

9 years

25 years

20 years

11 years

18 years

35 years

21 years

21 years

16 years

YEARS TO

PRODUCT I ON

average

5 years

average

20 years

average

16 years

average

22 years

LOOKING FOR BROADER ECONOMIC AND SOCIAL

CONTRIBUTIONS

The governments of many diamond producing

countries have a strong desire to ensure that

diamond extraction maximises local social and

economic benefits.

Diamond mining companies make substantial

direct and indirect contributions to local economic

development in most countries where they mine.

With lifespans that can cover decades, mining

projects require large-scale and long-term capital

investment, often reaching billions of US dollars.

This investment often attracts significant additional

inward investment to host countries. It results

in direct economic and fiscal benefits including

infrastructure development, provision of local

healthcare and education, direct employment, and

payment of taxes and royalties. Indirect benefits

include the development of a supply chain to support

the mining operations, skills development, indirect

employment and community support.

For example, in Canada, De Beers has numerous

comprehensive Impact Benefit Agreements (IBAs)

with aboriginal communities in the areas near the

company’s operations. These IBAs not only provide

compensation for any loss or potential loss of land

during the construction, operation and closure

of a mine, but they also provide a framework

regarding priorities for local training, employment,

business contracts, environmental management

and social investment in areas such as culture and

heritage activities.

In 2013, De Beers distributed more than US$5 billion

– or over 90 per cent of the value of total sales – to

governments, suppliers, employees, shareholders

and other finance providers. And of this, more than

US$3 billion was paid to stakeholders in Africa, where

De Beers has the greatest proportion of its operations.