44

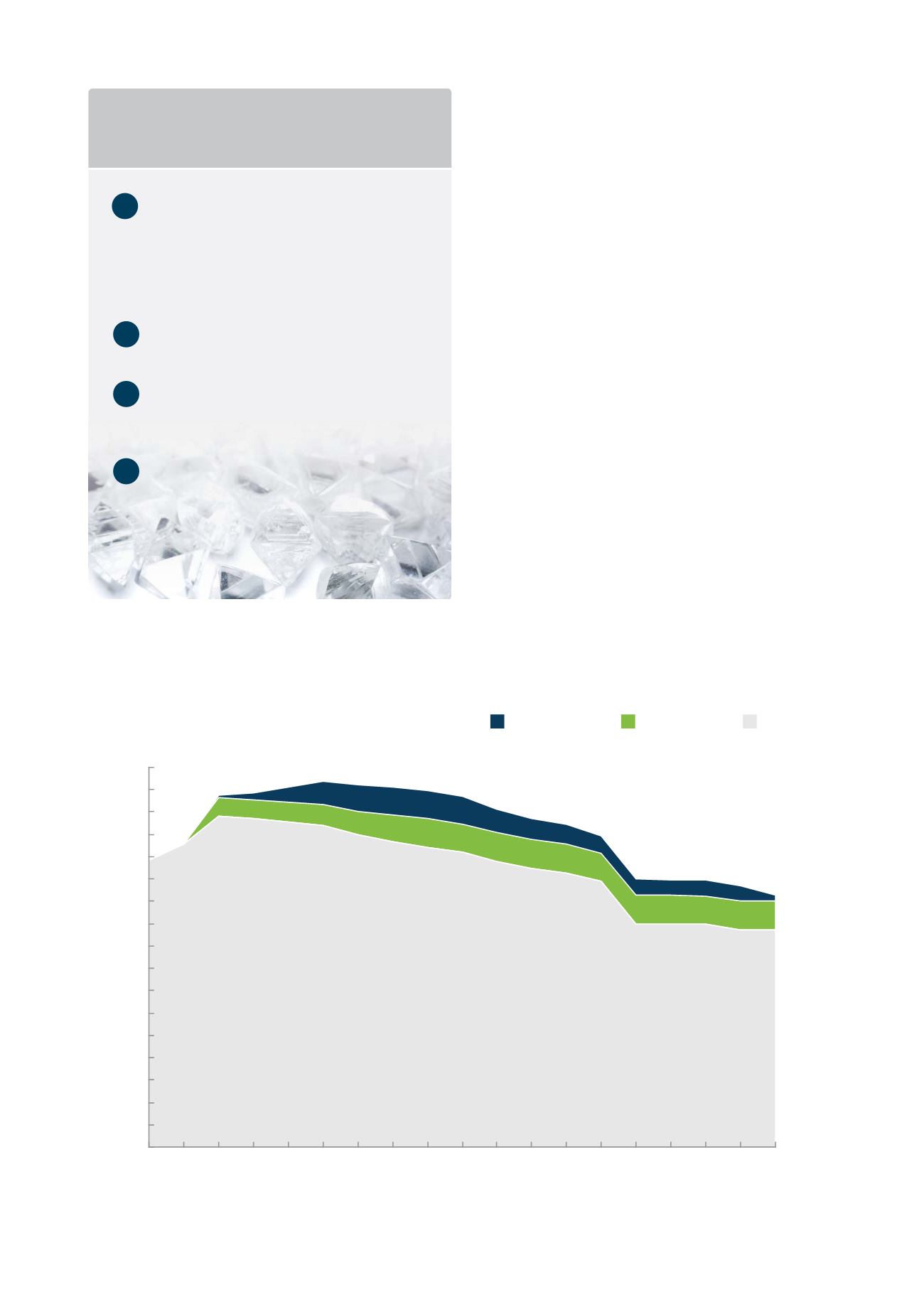

F I G . 2 7 :

PROJECTED GLOBAL ROUGH D I AMOND PRODUCT I ON

Source: McKinsey & Company, ‘

Perspectives on the Diamond Industry

’, September 2014

60

30

90

40

10

20

130

160

140

150

110

0

50

120

100

80

70

170

2023

2028

2029

2030

2025

2026

2024

2027

2022

2020

2017

2016

2019

2014

2013

2012

2021

2015

2018

Expansions

New projects

Existing

Million carats

LOOKING AHEAD

DIAMOND PRODUCTION IS EXPECTED TO FALL GRADUALLY

WHILE OPERATING COSTS WILL CONTINUE TO INCREASE

Overall diamond supply is expected to increase in

the next few years, driven by new projects coming

on stream. By 2020, when many of the existing mines

will begin to see declining outputs, overall supply is

expected to plateau (see Fig. 27).

A number of projects are under way to expand

diamond production. By 2020, about 25 per cent of

carat production will come from projects currently

under development, but much of this increase in

output comes from projected expansion at current

mines such as Rio Tinto’s Argyle mine in Australia.

Among new developments, the largest are ALROSA’s

Botuobinskaya, Lukoil’s Grib and De Beers’/

Mountain Province Diamonds’ Gahcho Kué projects.

Beyond 2020, there is a risk that production levels

will begin to decline unless major new discoveries are

made in the coming years and rapidly developed. As

illustrated elsewhere in this report (see ‘Diamond

Exploration’ chapter), the likelihood of large

economically viable discoveries is low, and so supply

can be expected to decline gradually after 2020.

1

2

3

4

Rio Tinto’s decision to continue to

operate in the diamond industry. Rio

Tinto conducted a strategic review of

its diamond business, which included a

potential divestment. In June, the company

announced its decision to retain the

diamond business

27

.

In April, Rio Tinto commenced

underground operations at its Argyle

mine in Australia

28

.

BHP Billiton’s exit from the industry upon

completing the sale of its stake in the Ekati

diamond mine to Dominion Diamond

Corporation in April

29

.

In October, the Russian government

privatised 16 per cent of its stake in

ALROSA, by way of an Initial Public

Offering, for US$1.3 billion.

MAJOR EVENTS IN 2013

DIAMOND PRODUCTION