9

The shift of cutting and polishing operations towards

low-cost centres in India and the Far East is likely to

have reached its peak. Over recent years, producing

countries such as Botswana, South Africa and

Namibia have been striving for increased domestic

beneficiation. However, the development of a long-

term sustainable cutting and polishing industry will

require not only government intervention but also

internationally competitive productivity levels.

Rough diamond sales and distribution

channels are

continuing to evolve, as producers experiment with

sales methods to maximise the value of their rough

diamonds. Over the last five years, auctions have grown

in importance and it is possible that, as technology

continues to evolve, this trend will continue. However,

the major rough diamond producers are expected to

continue to rely predominantly on long-term contracts

to sell their production.

Producing countries have been playing a more

important role in the sale and distribution of rough

diamonds. This is driven by national governments’

desire to increase their share of value from the

primary resource. The continuing trend towards

in-country beneficiation of diamonds saw perhaps

its largest milestone yet in 2013, with the move of

De Beers’ Global Sightholder Sales to Botswana, and

the organisation of De Beers’ first ever international

‘Sight’ in Gaborone in November 2013.

Rough diamond production

was an estimated 146

million carats in 2013, well below the 2005 peak of

over 176 million carats mined

1

. Overall diamond

supply is expected to increase moderately in the next

few years, driven by new projects coming on-stream.

By 2020, when many existing mines will begin to

see declining outputs, overall supply will be likely

to plateau and, unless major new discoveries are

made in the coming years, supply can be expected

to decline gradually from 2020.

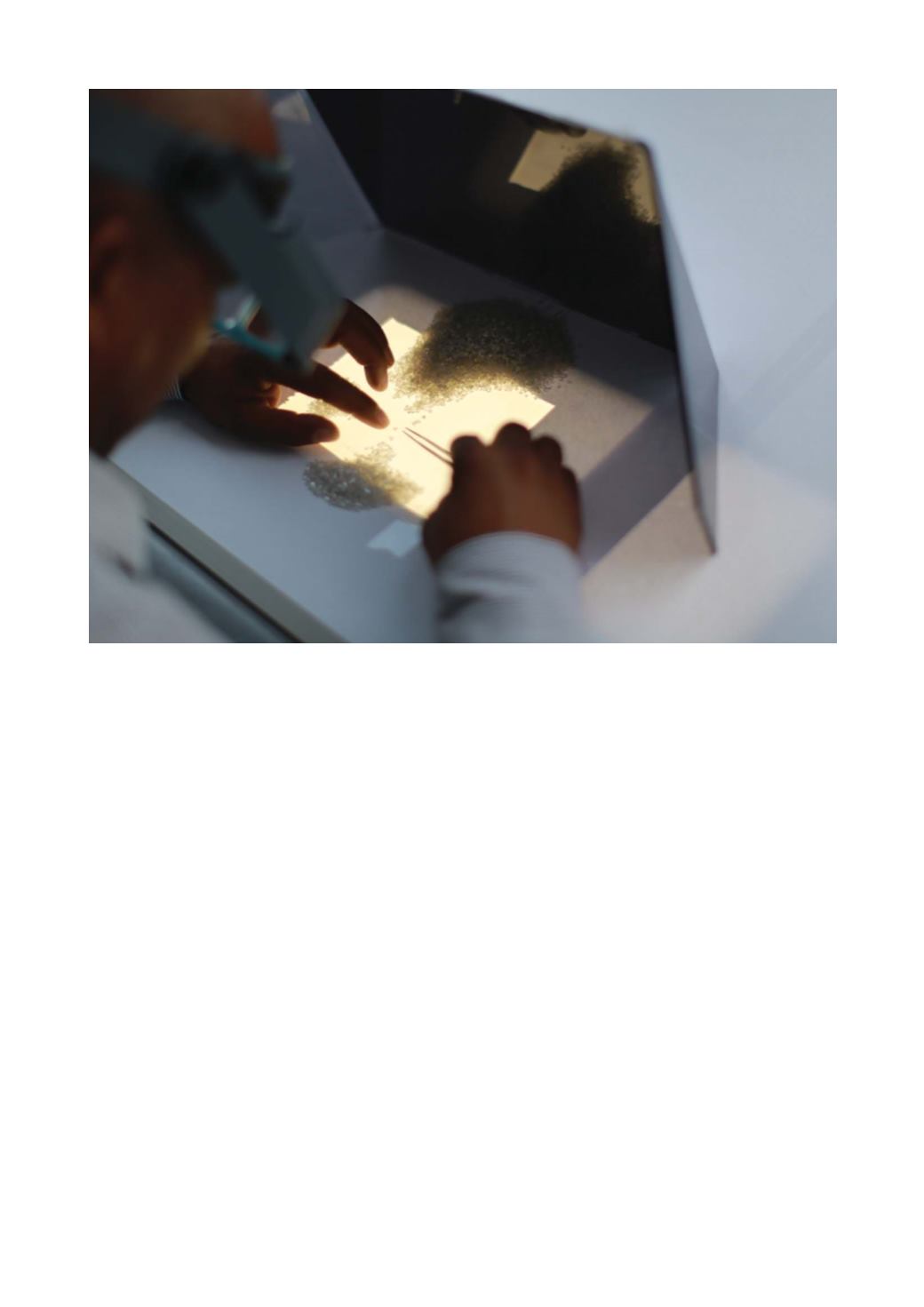

Diamond production is becoming increasingly

challenging as mining moves towards deeper, less

profitable and more remote sources of diamonds.

This trend is explored further in the ‘In Focus’

chapter, ‘The miracle of production’.

Exploration

spend is expected to remain high as

the chase to find the next major source of diamonds

intensifies. Today, most of the diamond exploration

spend takes place in historically underexplored

African countries such as Angola, the Democratic

Republic of Congo (DRC) and Zimbabwe, as well

as the vast swathes of Arctic Siberia and Canada.

Large-scale profitable discoveries will most likely

remain elusive, however. Viable diamond deposits

of any scale are rare and difficult to find, and no

amount of investment in exploration guarantees

the discovery of deposits on which sustainable

mining operations can be built.