22

US consumers account for the largest share of global

polished demand (ie polished diamond content) in

USD terms at approximately 40 per cent, followed by

China/Hong Kong/Macau (approximately 15 per

cent), India (approximately eight per cent), the Gulf

Region

3

(approximately eight per cent) and Japan

(approximately six per cent). Consumers in these top

five markets accounted for approximately 77 per cent

of total demand for polished diamonds in USD terms

in 2013.

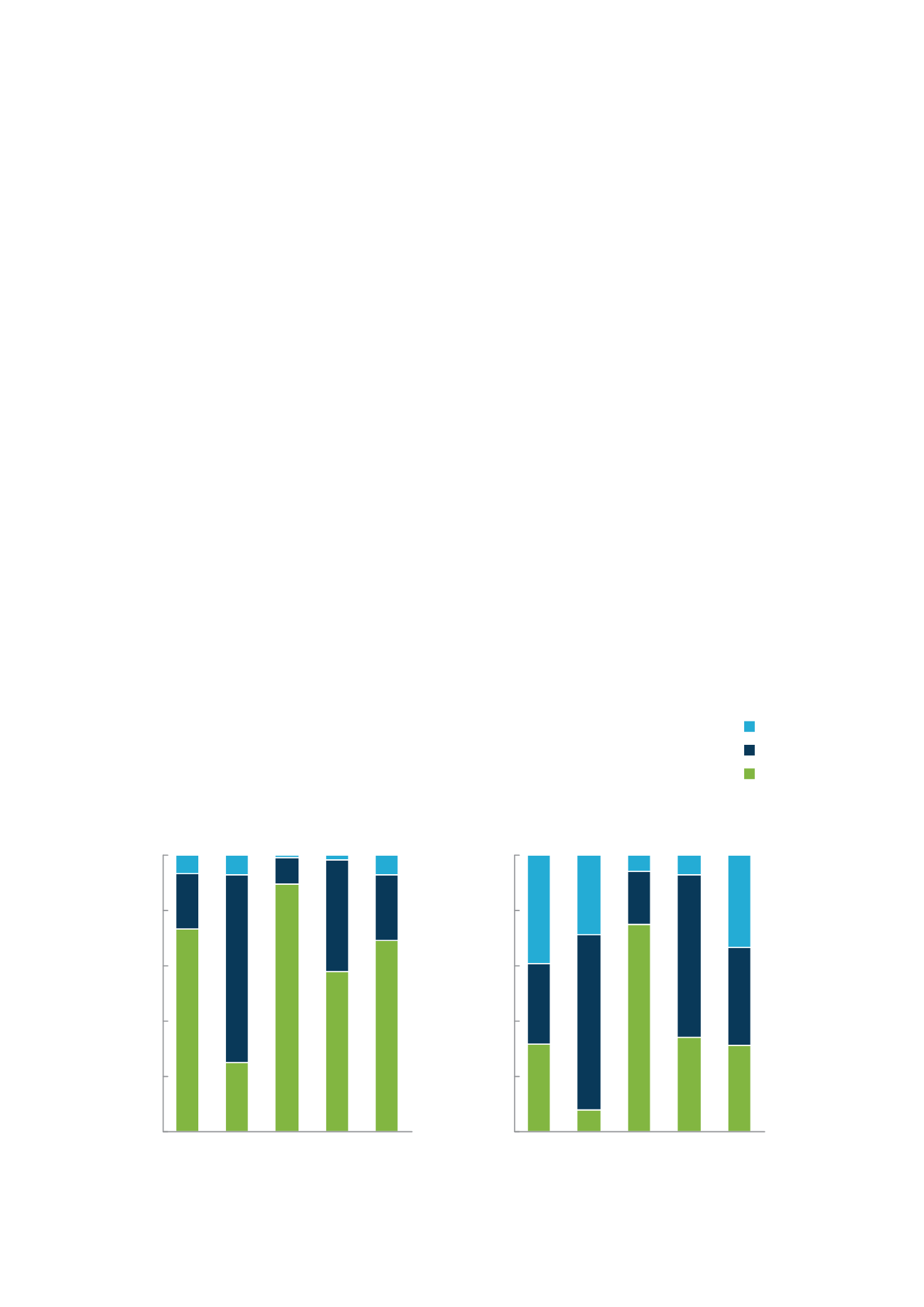

All main geographic markets consume all types of

polished diamonds. However, with the exception of the

US, which has a more evenly distributed consumption

across all types of polished diamonds, other markets

have particular focus areas of polished diamonds

(see Fig. 7). For example, India consumes mainly

stones under 0.08 carats of all clarities, while China

consumes mainly stones between 0.18 carats and 0.99

carats of medium and high clarity. In recent years,

there has been growing demand for larger and higher

clarity diamonds in both the US and China. This will

probably mean increased competition to secure supply

of the best jewels and, potentially, an increasing shift

in value towards those types of diamonds.

Another characteristic of the diamond jewellery

segment is the seasonality of demand. Different

geographic markets have different shopping seasons,

but Q4 tends to be the main sales season globally,

followed by Q1. Fig. 8 illustrates the main periods of

diamond jewellery acquisition by consumers for the

three largest diamond consumer markets. Of note

is the pronounced seasonality of the US in which a

high proportion of pieces are acquired by consumers

between Thanksgiving and Christmas. Other markets

have slightly less pronounced seasonal patterns.

LOOKING AHEAD

A detailed view of future consumer trends for the

diamond industry’s most important markets, the US

and China, is provided in the ‘In Focus’ section of this

report: see ‘Changing consumer preferences and the

growth of brands in the United States and China’.

Source: De Beers

F I G . 7 :

TYPE OF POL I SHED D I AMOND SOLD I N MA I N D I AMOND JEWELLERY

MARKETS , BY S I ZE BAND

Note:

Large = 1+ carat, Medium = 0.18-0.99 carat, Small = <0.18 carat

MARKET SPLIT BY VOLUME,

Carats

2013 polished diamonds in jewellery sales, per cent

100

80

60

40

20

0

Gulf

Japan

India

China

US

MARKET SPLIT BY VALUE,

USD

100

80

60

40

20

0

Gulf

Japan

India

China

US

Small

Medium

Large