26

ON THE WHOLE, EMERGING MARKET RETAILERS HAVE

OUTPERFORMED DEVELOPED MARKETS

For retailers in emerging markets such as China and

India, sales of gold and gold jewellery, normally a

low margin category, represent the majority of their

revenues. However, retailers in these markets selling

diamond jewellery have benefited from structural

factors: growing economies, an increasing base of

consumers with appetite for diamonds and expanding

number of stores selling diamond jewellery. In

China, there is also a benefit from relative sector

consolidation, with multiple jewellery retailers

operating ‘at scale’.

Over the past few years, however, EBIT margins

(which for the major listed developing market

jewellers are similar to those of leading developed

market peers) have come under pressure

8

as jewellery

input costs have increased and the pace of expansion

has slowed (see Fig. 11). In addition, gold demand

volatility has also played a role in weakening financial

results. As economic growth decelerates in the next

few years, and competition increases, it is likely that

margin pressures will also build for diamond jewellery

retailers in emerging markets.

THE IMPORTANCE OF ONLINE CHANNELS RISES ACROSS

THE WORLD

Both emerging and developed markets saw a rise in

the importance of online channels in 2013. More

than one in six diamond jewellery purchases in

the US were made online in 2013, a growth of over

30 per cent since 2011 (see Fig. 12). Going online

also remains the most popular way for consumers

to research a purchase in the US: almost four in 10

consumers go online for research purposes before

buying, ahead of other touch-points such as jewellery

stores and advertisements (see Fig. 13).

Although online is not yet a significant sales channel

in China, the internet is already used by a quarter

of acquirers for different purposes, such as to learn

about fine jewellery quality and prices, to learn about

brands, and to pre-select designs. The internet is used

more frequently in the diamond purchase process by

single women, half of whom use it, and also by affluent

consumers, about six in 10 of whom research online.

Online, including mobile usage, can be expected to

grow in importance for diamond jewellery retailers

everywhere, be it for research purposes before a

purchase or as a sales channel (pure or hybrid, via

web sales with store pick-up).

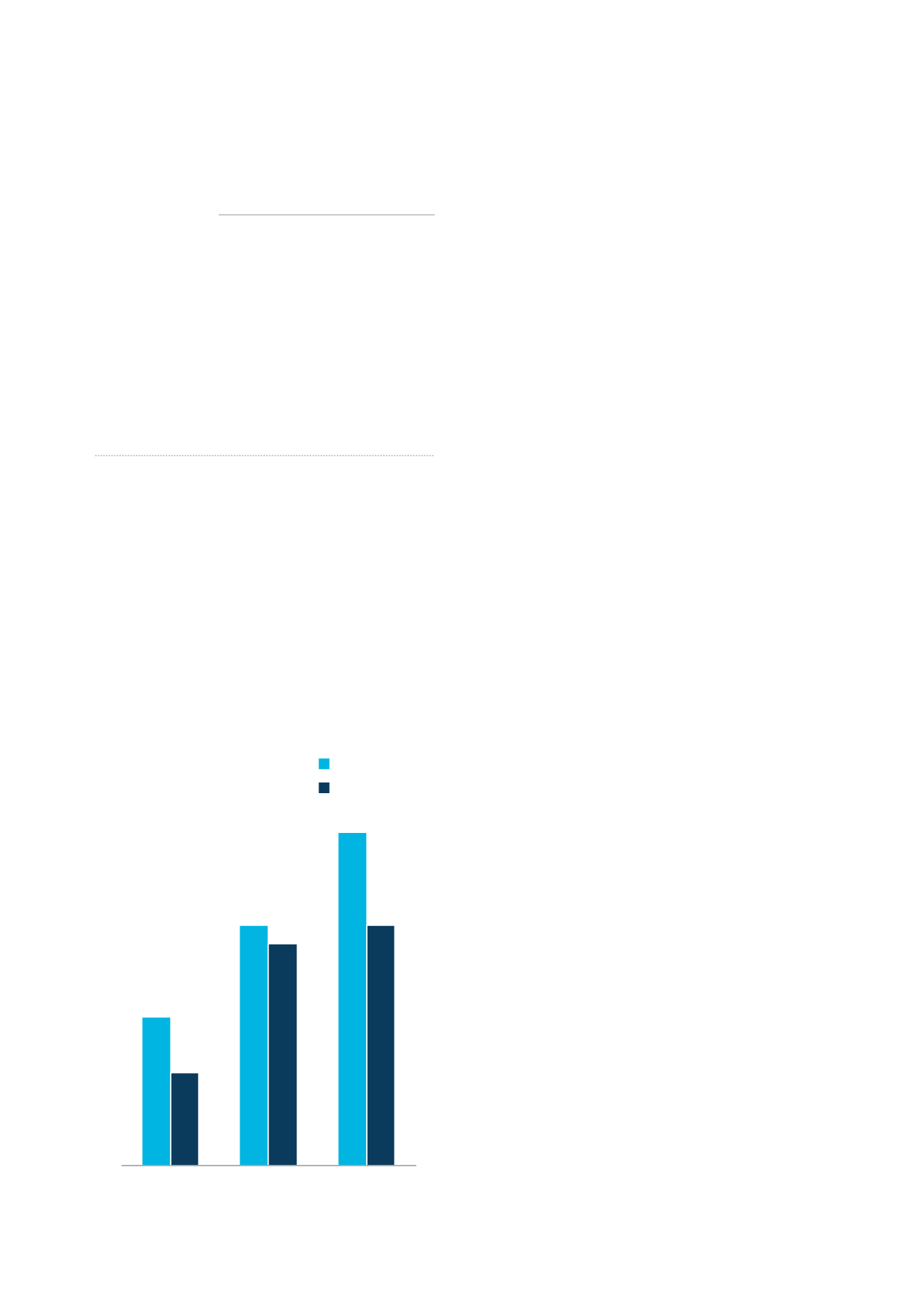

FIG. 12:

GROWTH OF ONLINE DIAMOND JEWELLERY

SALES IN THE UNITED STATES

Source: De Beers

2013

13

18

2011

12

13

2006

5

8

Per cent of value

Per cent of pieces

Share of online acquisitions in total women’s

diamond jewellery market

FIG. 11:

FINANCIAL RATIOS FOR A SELECTION OF

LISTED JEWELLERS IN EMERGINGMARKETS

Source: Bloomberg

Chow Sang

Sang

7

4

7

7

Luk Fook

Holdings

22

12

11

19

Lao Feng

Xiang

15

4

5

14

Hengdeli

Holdings

8

8

11

10

Thangamayil

Jewellery

1

1

5

12

Tribhovandas

Bhimji Zaveri

8

7

9

12

ROIC

2012 Most recent

EBIT

2012 Most recent

Chow Tai

Fook

14

12

15

13

CHINA

Titan

Company

22

10

10

35

INDIA

Per cent