31

CONTINUED CONSOLIDATION CAN BE EXPECTED

A possible response to rising consumer expectations,

and the increased investment required to support

them, could be retailer consolidation. In fact, given

the recent weakness in the world’s economy and the

number of underperforming retailers, consolidation

might already have been expected to happen.

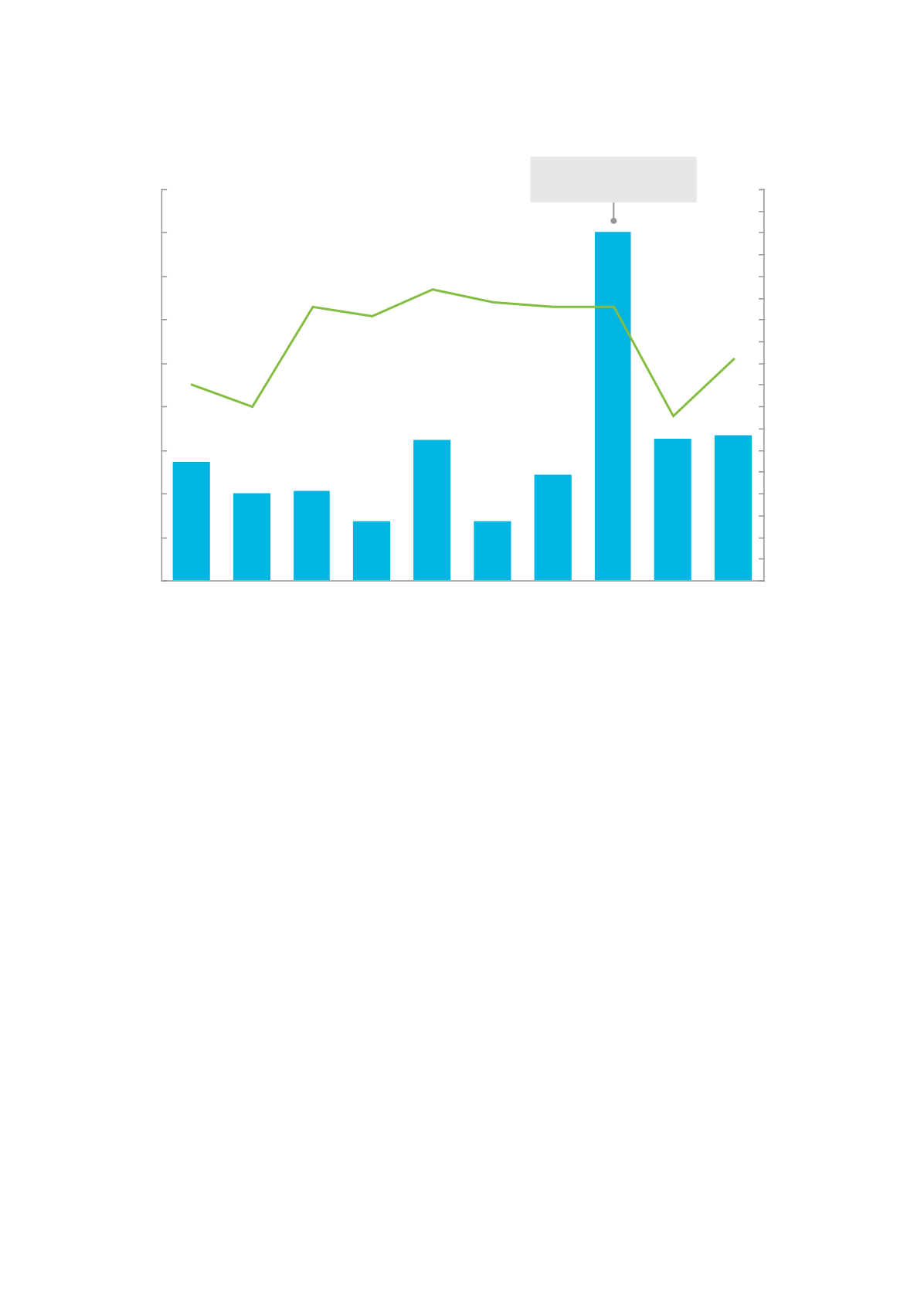

In reality, deal numbers and volumes in the industry

have grown slowly, at only two per cent CAGR from

2003 to 2013

14

(see Fig. 16).

The recent transaction announced between Zale

Corporation and Signet Jewelers in the US may signal

a change in the US jewellery retail space. The new

combined Signet/Zale entity could have as much as

10 per cent of total diamond jewellery sales in the US.

The US$100 million of annual savings estimated to

be achieved by fiscal year-end 2018

15

, which the new

entity hopes to generate through store rationalisation

and increasing buying power, are meant to support its

profitability and allow it to invest in responding to the

changing consumer landscape.

F I G . 1 6 :

JEWELLERY MARKET M&A VOLUMES AND NUMBERS OVER T IME

Source: Dealogic

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

0

5

10

15

20

25

30

35

40

45

50

55

60

65

70

75

80

85

90

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

# DEALS

SUM OF DEAL VALUE

USD million

Includes US$5.2 million

LVMH/Bulgari deal