37

This is one of the main reasons why the governments

of southern African countries, for example, have been

keen to ensure their countries expand along the value

chain to sectors that create more jobs, such as cutting

and polishing.

At the same time as creating local jobs, beneficiation

policies create a challenge. Lower worker productivity

means that cutting costs are higher in southern Africa

than in countries such as India, and so the move

towards local cutting increases costs and reduces the

profit pool that can be shared between producers and

governments (see Fig. 19).

In order for local beneficiation to be sustainable in the

long term, producing countries will need to make an

effort to develop competitive downstream industries

that can create value as well as generate jobs.

This will require investment in skills development and

infrastructure as well as thoughtful regulation. Only in

this way can the downstream diamond industry ensure

long-term job creation that will attract investors and

developers to the sector.

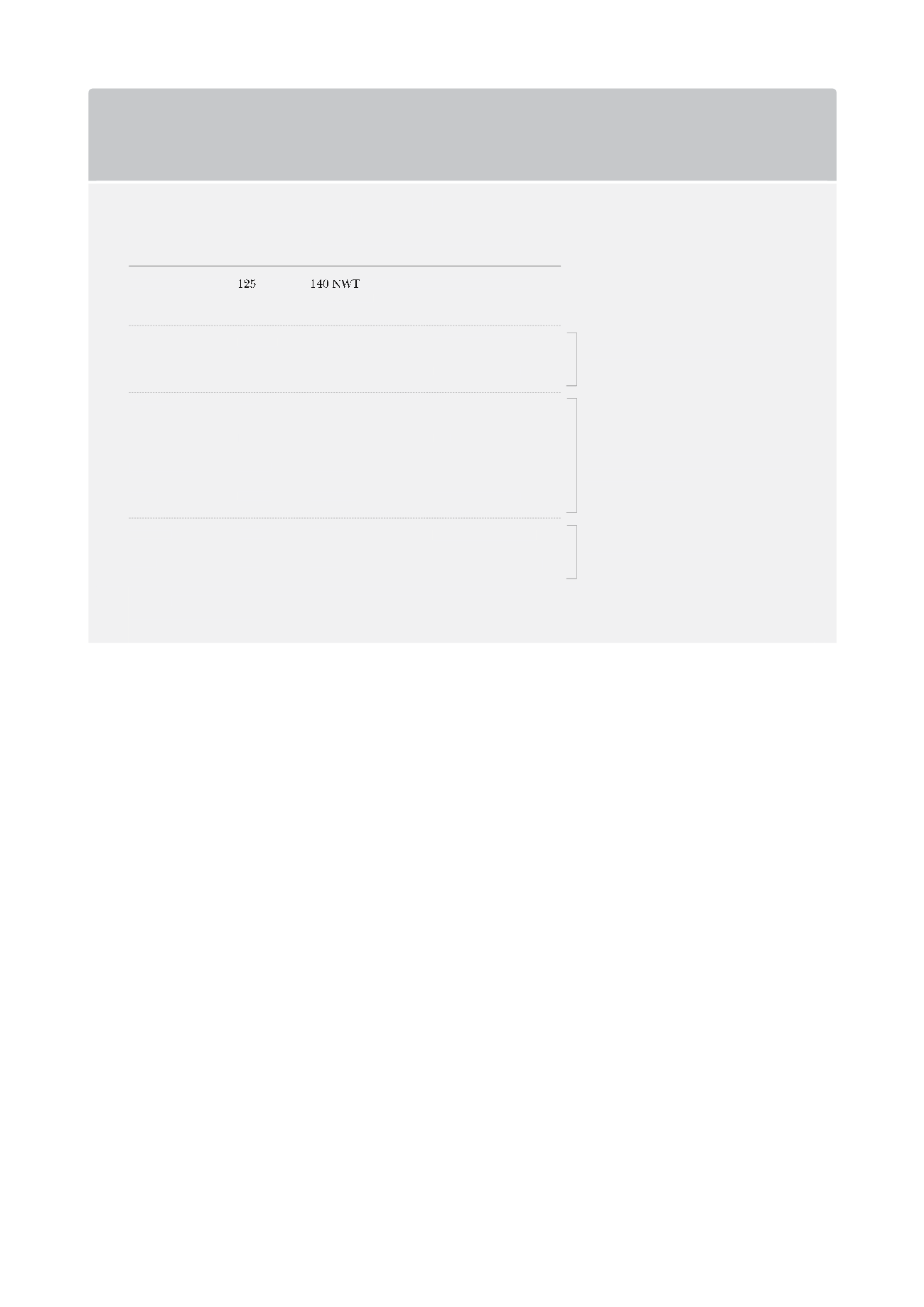

APPROXIMATE TOTAL

CUTTING AND POLISHING JOBS

APPROXIMATE CUTTING AND

POLISHING COSTUSD/CARAT

i

Producer countries are gaining share on

the back of government policy, despite

higher costs than traditional

manufacturing locations

‘Old’ cutting locations have lost share of

manufacturing following migration first to

low-cost locations and subsequently to

producer countries

The trend of growth in low-cost locations

has recently started to reverse

2008

CUTTING CENTRE

Canada

300

50-80

0 NW

180 Ontario

25

2,200

3,750

60-120

45->125

Botswana

1,000

150-200

150+

120

Belgium

1,000

1,800

130-150

60-100

South Africa

2,000

400

140->300

47->55

Israel

29,000

10,000

20-50

15-35

Far East

850,000 800,000

10-50

6-50

India

2013

2008

2013

,500

5 > 25

Namibia

970

1

60-140

4 - 1

US

80-100

100

300

110

Source: De Beers estimates

i

These are estimates for the majority of production units and exclude outliers

FIG. 19:

CONSENSUS VIEW OF CUTTING AND POLISHING COSTS AND

EMPLOYMENT IN CUTTING CENTRES