35

WHAT ARE YOUR KEY CONCERNS REGARDING THE FINANCIAL

HEALTH OF THE MIDSTREAM?

There is general lack of transparency in business

practices and quality of reported financials across

the midstream, leading to a loss of trust. This is

compounded by the fact that the midstream is highly

levered. Banks are therefore being more critical and

thorough with funding decisions, and looking for a

greater level of security against their loans.

HOW DO YOU THINK THE MIDSTREAM CAN ADDRESS THESE

CONCERNS FOR THE FUTURE? WHO HAS BETTER ACCESS TO

FUNDING AND WHY?

When approaching financing decisions, we assess the

‘bankability’ of the clients – whether their business is

in good financial health with transparent business

plans, if they apply IFRS or equivalent GAAP

standards especially when reporting receivables and

inventory, and streamlining processes such as the

removal of inventory round-tripping. Financiers

reward sound fiscal management and good

compliance by providing better lending conditions

and more favourable rates. I also believe in openness

between banks and their clients in order to work

through any issues – which in the end comes back to

the importance of transparency.

WHICH DO YOU BELIEVE ARE THE MOST SUCCESSFUL PLAYERS

IN THIS INDUSTRY AND WHAT ARE THEY DOING THAT IS

MAKING THEM SUCCESSFUL?

In an increasingly competitive landscape,

competitors have to adopt strategies to ensure

survival and sustainability. Sustainability, in

my opinion, is the right to exist. This is achieved

by being prepared to compete in a saturated

space with dynamic and flexible business plans,

investment in infrastructure and technology and

diversification. Some successful players have shown

innovative manufacturing and cutting strategies

to produce greater yields as well as developing a

unique product.

DO YOU EXPECT CONSOLIDATION GOING FORWARD?

The rate of change is still very slow, so I do not

envisage much consolidation in the next five years

or so. However, I do see the competitive landscape

getting tougher, which will lead to those less

sustainable businesses disappearing.

Q

Q

Q

Q

Many midstream companies now also offer a

consumer branded proposition that creates a

unique identity around the precision cuts they

manufacture. These include Leo Schachter with

the Leo cut, Exelco with Tolkowsky and Crossworks

with the Ideal Square and Ideal Cushion.

THERE WILL BE A CONTINUED PUSH FOR IN-COUNTRY

BENEFICIATION

When it comes to the geographical location of cutting

and polishing, the move towards low-cost centres in

India and the Far East is likely to have reached its

peak. Over recent years, producing countries such

as Botswana, South Africa and Namibia have been

striving for increased domestic beneficiation, leading

to some cutting and polishing jobs migrating to

those countries.

Diamonds are critical to the economies of some

producing nations. In Botswana, for example,

diamonds represent more than one quarter of GDP

18

and over three-quarters of overall exports

19

, whereas

in Namibia they represent eight per cent of GDP

20

,

and almost 20 per cent of exports

21

(see Fig. 18).

However, diamond mining in itself only creates a

limited number of jobs (as is also the case with other

types of mining) since it is capital-intensive rather

than labour-intensive.

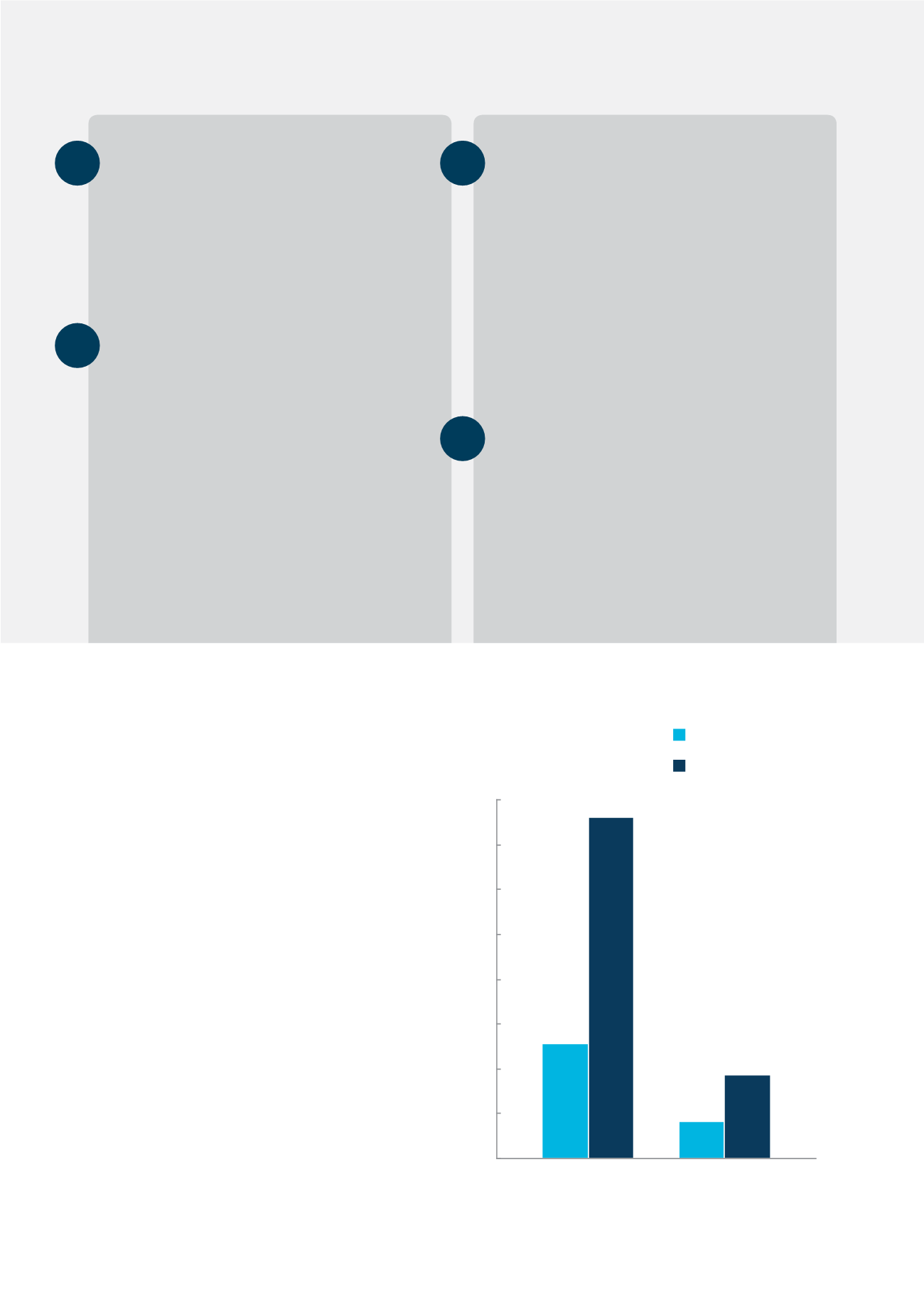

FIG. 18:

DIAMONDS’ SHARE OF GDP IN KEY

PRODUCING COUNTRIES IN 2013

Source: The World Bank; Kimberley Process Statistics; De Beers analysis

Per cent

10

60

70

80

50

0

30

40

20

26

8

76

19

Diamond production, by

value, as per cent of GDP

Diamond exports, by value,

as per cent of total exports

Namibia

Botswana