38

ROUGH D I AMOND SAL ES

AND D I STR I BUT I ON

2013 SNAPSHOT

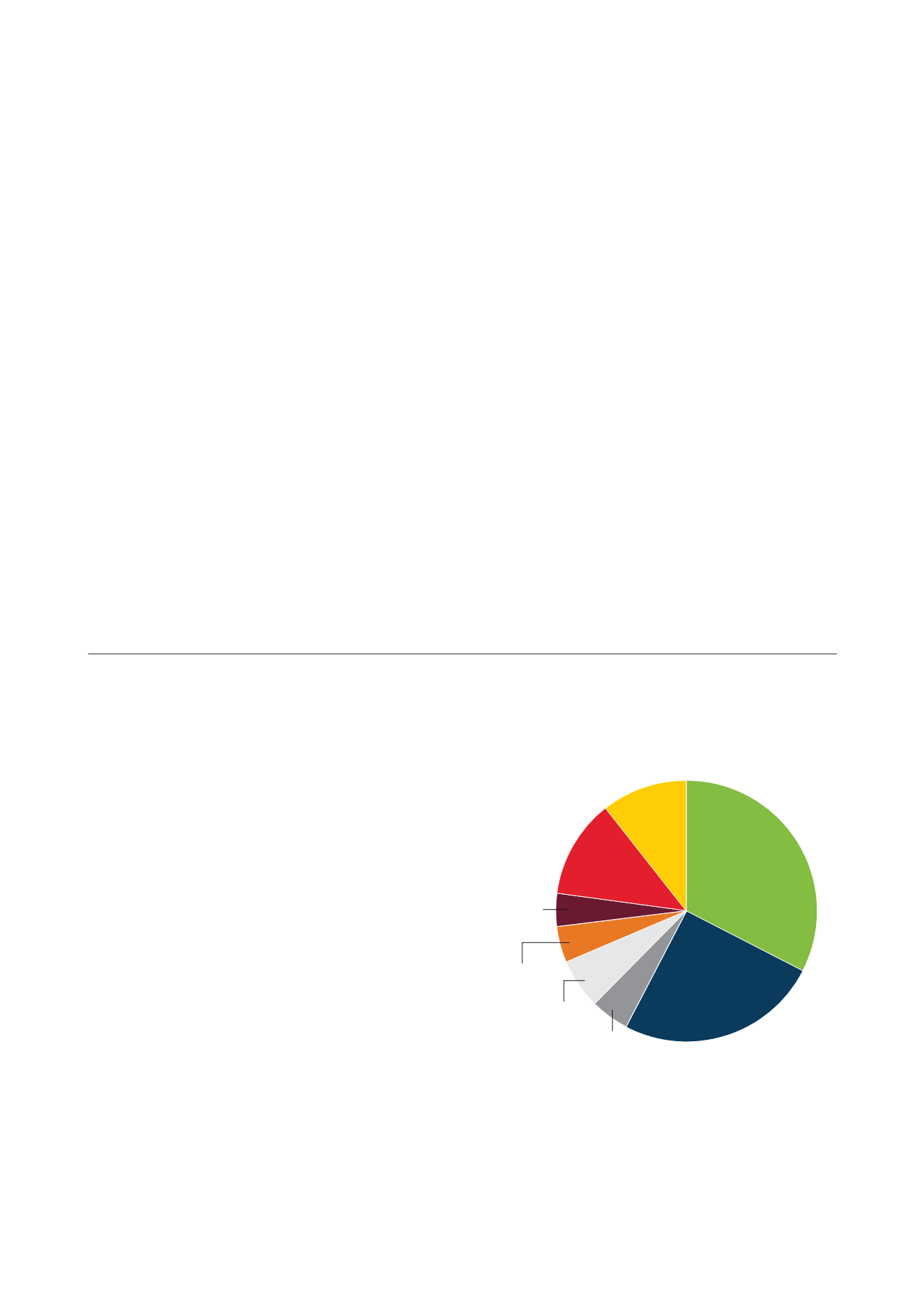

Global rough diamond sales by producers increased

approximately five per cent from 2012 to 2013, to

reach a total of just under US$18 billion.

De Beers remained the largest supplier with roughly

33 per cent of overall sales measured by value (the

same share as in 2012), followed by ALROSA with

25 per cent of sales (vs 23 per cent the year before).

Other primary suppliers included SODIAM (Angola)

with an estimated six per cent share, Rio Tinto

with a five per cent share and Dominion Diamond

Corporation and the Zimbabwe alluvial producers

with about four per cent each, all in approximate

USD value terms (see Fig. 20).

A variety of rough diamond sales channels are used

by primary suppliers (see Fig. 21). De Beers uses

multi-year contracts with more than 80 term contract

clients – Sightholders – to sell most of its production.

De Beers has also used sophisticated online auctions

since 2008 to sell a proportion of the Group’s

production. In recent years, ALROSA has established

three-year supply agreements with a selection of

customers and supplements these sales with one-

time sales as well as competitive bidding (auctions)

22

.

However, some producers, such as Gem Diamonds

and Petra Diamonds, use an auction-only platform.

FIG. 20:

GLOBAL ROUGH SUPPLY

Source: De Beers

Per cent

i

Okavango Diamond Company sales are accounted for in the De

Beers number as sales from DTC Botswana

ii

Excludes sales of polished diamonds and sales of rough

diamonds to Gokhran

iii

Company Annual/Quarterly Reports

iv

De Beers estimates

v

Includes 40 per cent of Diavik production and 80 per cent of

revenue from Ekati from April 2013

vi

Company reports including Gem, Petra, Firestone, Lucara,

Kimberley Diamonds, among others

2013 ROUGH DIAMOND SALESBY VALUE SHARE

De Beers

i

33

ALROSA

ii

25

Rio Tinto

iii

5

SODIAM

iv

6

Artisanal/

Informal

iv

12

Other

vi

11

Zimbabwe/

Marange

(Chiadzwa)

iv

4

Dominion

v

4