32

CUTT I NG AND

POL I SH I NG

2013 SNAPSHOT

The cutting and polishing industry is global in nature.

It remains fragmented, with thousands of companies

operating with multiple business models, including

wholesalers, rough dealers, manufacturers and

polished dealers, as well as combinations of these

activities. The Israel Diamond Exchange, for example,

has more than 3,000 members

16

, many of which are

very small companies or sole proprietors. Even among

the leading companies in the sector, there are many

traditional family-owned businesses with a long history

in the diamond industry.

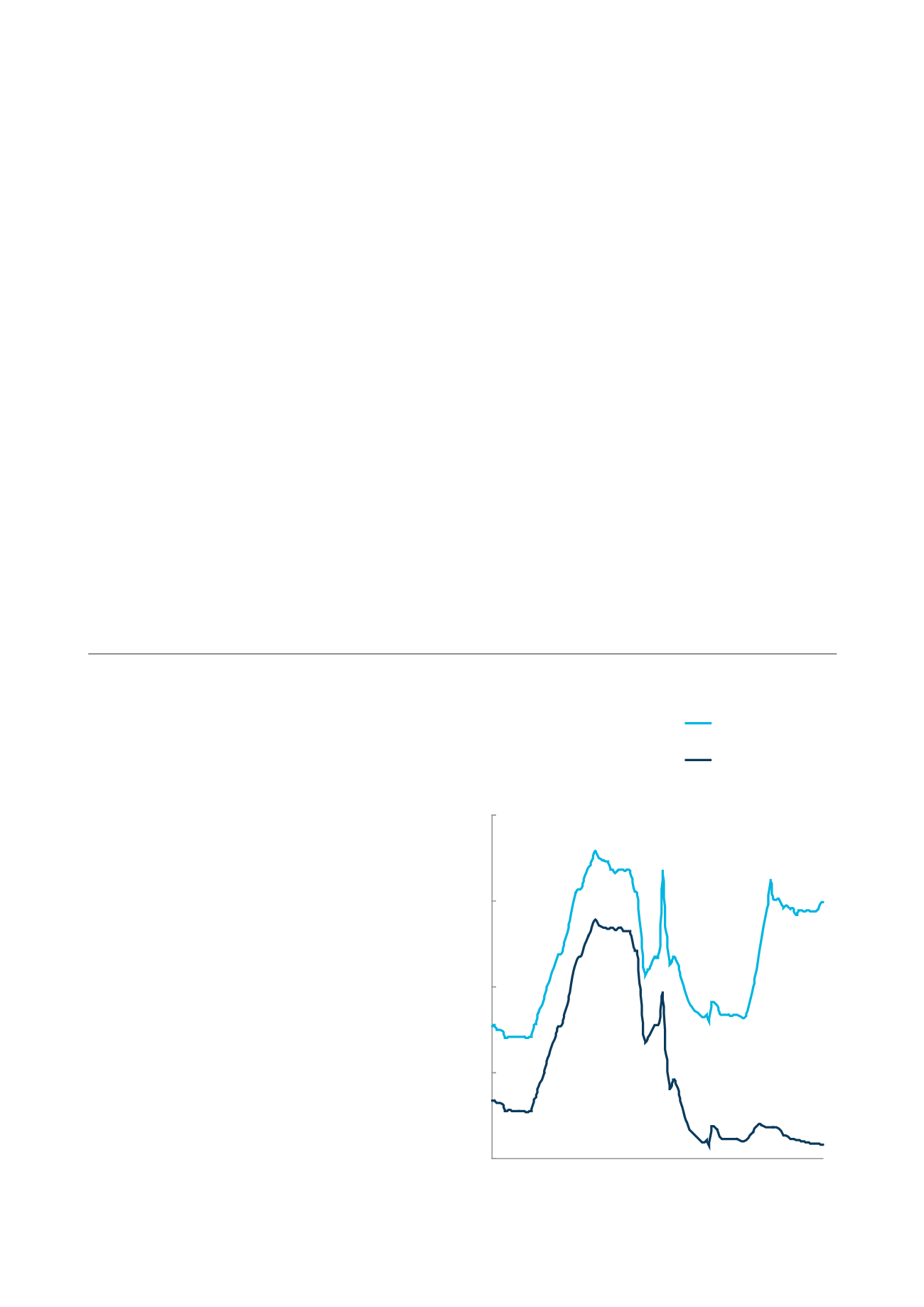

However, recent years have seen the midstream sector

coming under increasing pressure for a number of

reasons. These include lower carat supply, increasing

costs in the upstream, and growing pressure from

the retail sector, where consumers make higher

demands and brands take greater share (as described

in the ‘Diamond Jewellery Retail’ chapter of this

report). These trends are compounded by significant

financing challenges: as polished demand increases,

the midstream needs additional funding. Declining

overall central bank interest rates

17

have not resulted

in lower borrowing costs for midstream companies,

indicating that banks perceive increasing risks in the

diamond sector overall (see Fig. 17).

FIG. 17:

DIAMANTAIRES’ BORROWING COSTS OVER

TIME VS LIBOR RATES

Source: De Beers estimates; ICE Benchmark Administration Limited

(IBA) for Libor rates

8

6

4

2

0

2011

2010

2014

2013

2012

INTEREST RATE

2009

2008

2007

2006

2005

2004

2003

Average interest rate

paid by diamantaires

Libor

Per cent